401k Pre Tax Limit 2025

401k Pre Tax Limit 2025. Standard deduction of rs 50,000 is. Union budget 2023 made significant changes to the new personal tax regime tax slabs such as an increase in the basic exemption limit to rs 3 lakh from rs 2.5 lakh,.

The legislation requires businesses adopting new 401 (k) and 403 (b) plans to automatically enroll eligible. You can make contributions to a 2024.

Currently The Basic Exemption Limit Under The New Income Tax Regime Is Rs 3 Lakh.

Standard deduction of rs 50,000 is.

Find Out The Irs Limit On How Much You And Your Employer Can Contribute To Your 401(K) Retirement Savings Account In 2023 And 2024.

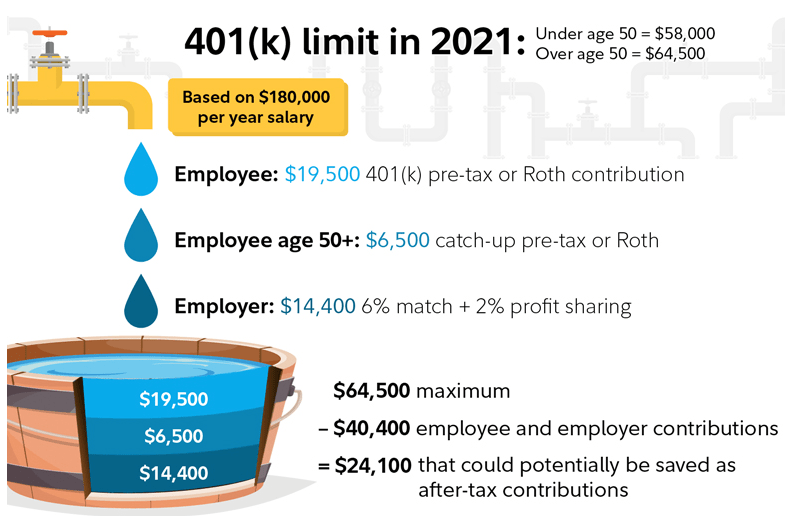

The 401 (k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

401k Pre Tax Limit 2025 Images References :

Source: www.financialsamurai.com

Source: www.financialsamurai.com

401k By Age PreTax Savings Goals For Retirement Financial Samurai, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). For 2024, that limit is $23,000 for all but simple 401(k) plans.

Source: tcgservices.com

Source: tcgservices.com

Choosing the Right Retirement Plan Contributions PreTax, Roth, or, For 2024, that limit is $23,000 for all but simple 401(k) plans. There are actually multiple limits, including an individual.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), You can make contributions to a 2024. 401 (k) automatic enrollment under secure 2.0.

Source: seekingalpha.com

Source: seekingalpha.com

401(k) Plans Come With Choices That Will Affect Your Future RMDs, The milliman 2025 irs limits forecast was updated recently using the u.s. Automatic enrollment and automatic plan portability.

Source: moderawealth.com

Source: moderawealth.com

Best Guide to 401k for Business Owners 401k Small Business Owner Tips, More than this year, if one firm’s forecast is any indication. That's an increase from the.

Source: www.financestrategists.com

Source: www.financestrategists.com

What Are the Types of 401(k) Plans? Definition and Advantages, Income tax expectations budget 2024: If you're age 50 or.

Source: merriellewanitra.pages.dev

Source: merriellewanitra.pages.dev

2024 Ira And 401k Limits Shea Florette, What is the 401(k) tax limit? There are also income requirements to contribute to a roth ira.

Source: www.usepigeon.io

Source: www.usepigeon.io

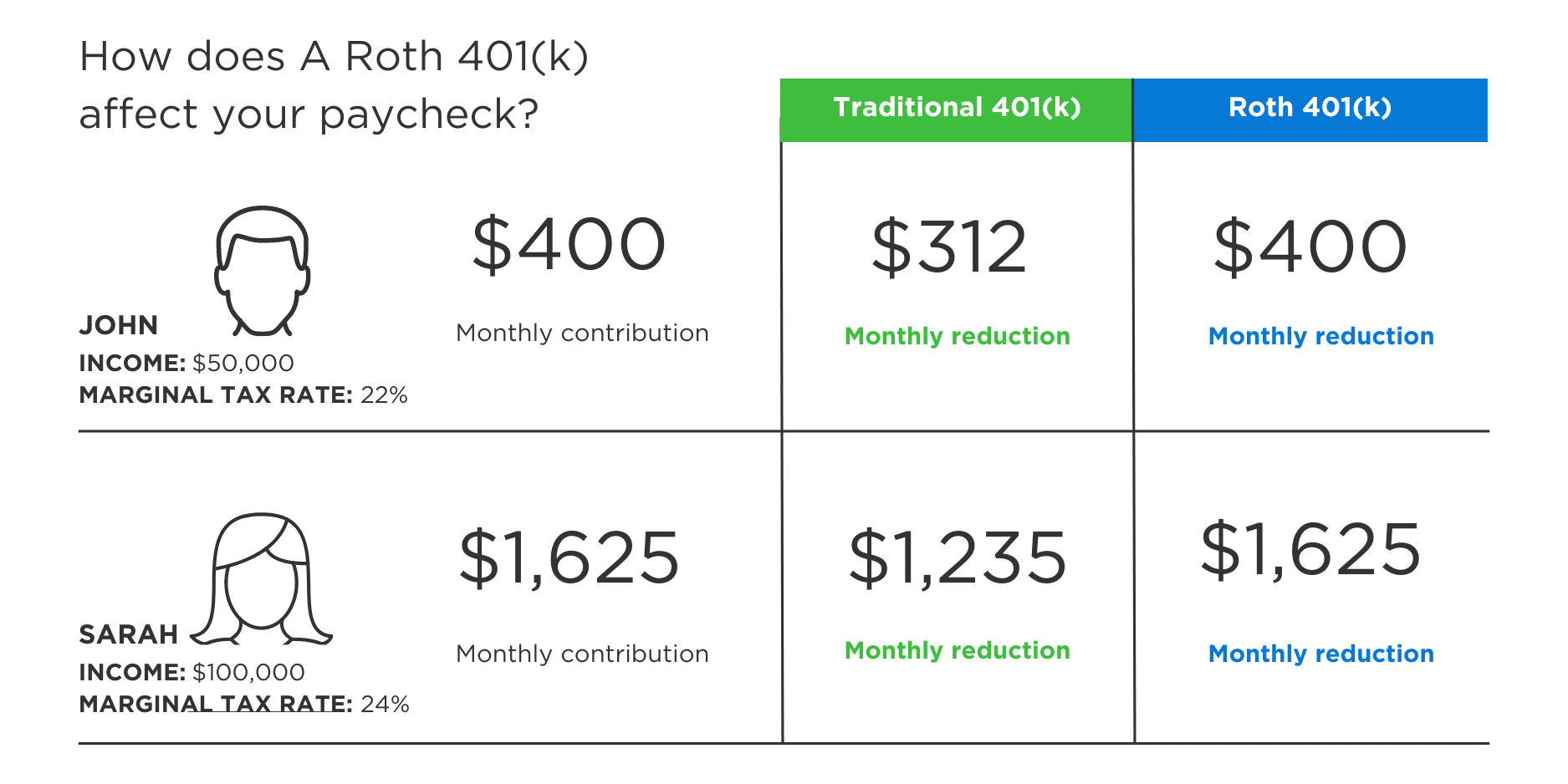

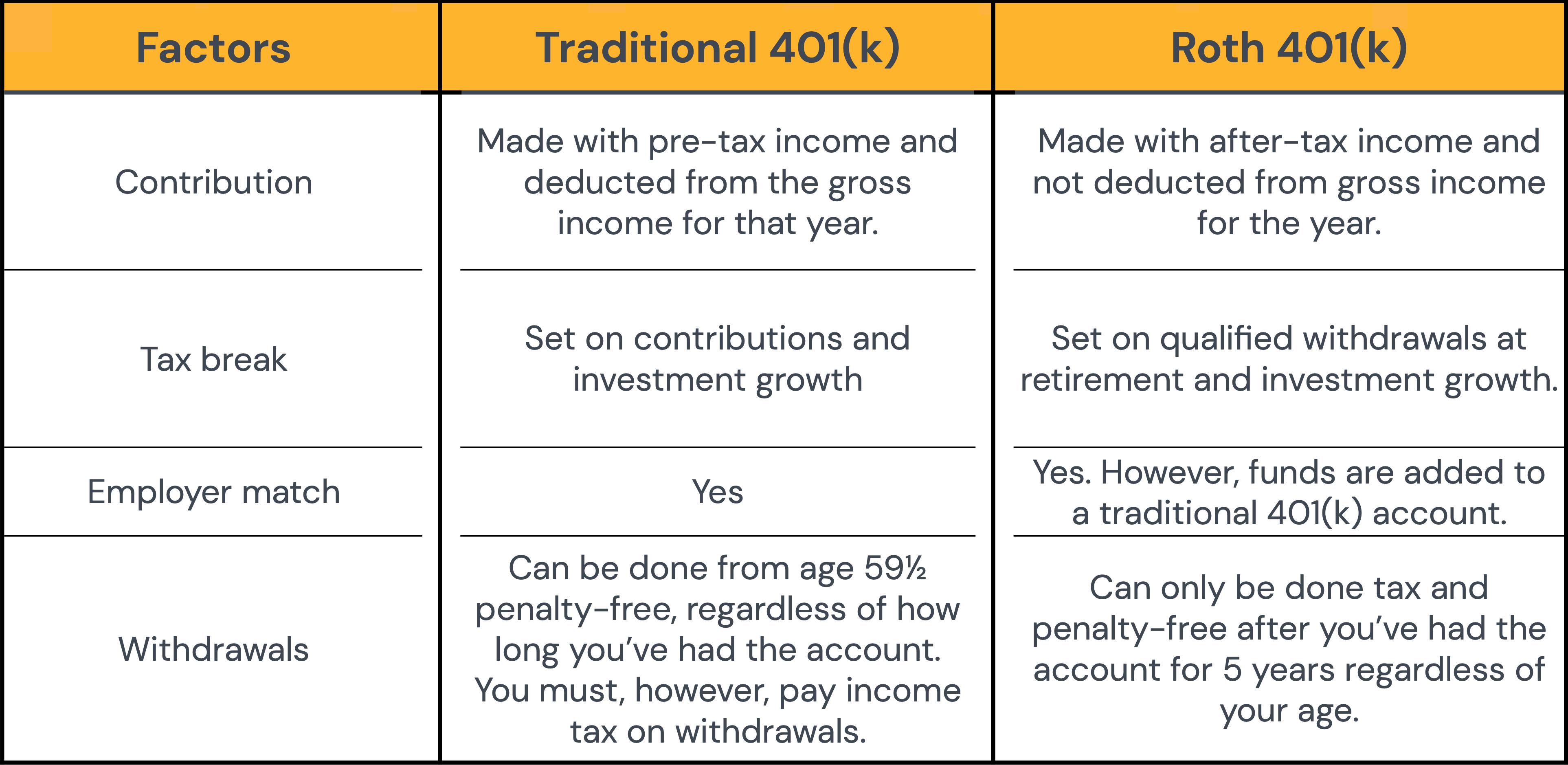

The Differences Between a Roth 401(k) and a Traditional 401(k), Beginning in 2025, the secure 2.0 act expands automatic enrollment. The 401 (k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

Source: shawneewklara.pages.dev

Source: shawneewklara.pages.dev

401k Matching Limits 2024 Cyndy Doretta, The 401k contribution limit for 2025 will be determined by the internal revenue service (irs) based on inflation and legislative changes. Income tax expectations budget 2024:

Source: jesselynwsalli.pages.dev

Source: jesselynwsalli.pages.dev

When Will Irs Announce 401k Limits For 2024 Cindy Deloria, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). For 2024, that limit is $23,000 for all but simple 401(k) plans.

The Legislation Requires Businesses Adopting New 401 (K) And 403 (B) Plans To Automatically Enroll Eligible.

That's an increase from the.

Automatic Enrollment In Retirement Plans.

For 2024, that limit is $23,000 for all but simple 401(k) plans.

Posted in 2025